We created a simple Trading Strategy using Exponential Moving Average crossovers that shows the power of the Adaptive Consolidated Bars.

The top Trading Strategy uses Consolidated bars, while Trading Strategy #2 uses the same rules with Adaptive Consolidated Bars.

In the Trading Strategy at the top of the chart we used an Exponential Moving Average crossover of Consolidated Bars.

Buy Long Conditions:

Cross Above (ExpAvg (Consolidated Bar Low), ExpAvg (Consolidated Bar Close))

Sell Short Conditions:

Cross Below (ExpAvg (Consolidated Bar High), ExpAvg (Consolidated Bar Close))

We set up the system to trade 75% of the account balance, which started out as $60,000, and used a margin of $8,500 and a Point Value of $100.

The out-of-sample Return on Trades was 30.4% compared to a percent change in price of -0.7 for buy and hold during the same period.

Trading Strategy #2 used the same account settings and substituted Adaptive Consolidated Bars in the Exponential Moving Averages.

The out-of-sample Return on Trades showed was 82.8% compared to the percent change in price of -0.7 for buy and hold. Trading Strategy #2 used the same date ranges as the first Trading Strategy.

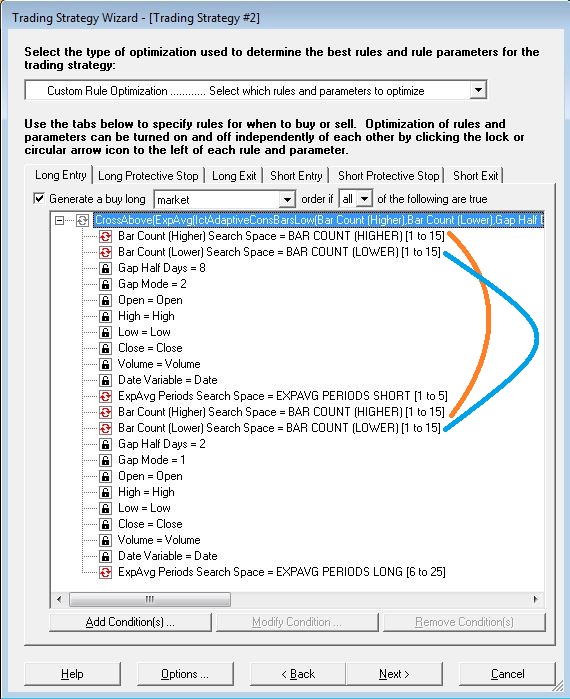

Linking Bar Count Parameters

If you're using multiple Adaptive Consolidated Bars in the same trading rule It's important to link the Bar Count (Higher)

optimization range to all other instances of the same rule. The same is true for the Bar Count (Lower) range.

The ranges for the Higher and Lower bar counts were linked to prevent optimization from trying to combine a different number of bars in the short and long exponential moving averages. Failing to link the parameters could mean that crossover would never occur if the short period moving average was built with a consolidation of 5 higher bars while the long period moving average was built with a consolidation of 3 higher bars. You also have to link the Bar Count (Lower) parameters for the same reason.

Linking does not mean that you lose the power of Adaptive Consolidated Bars where bars based on rising prices can consolidate x number of bars and bars based on falling prices can consolidate y number of bars. It does mean that all Bar Count (Higher) parameters must be linked and all Bar Count (Lower) parameters must be linked.

Related Topic: