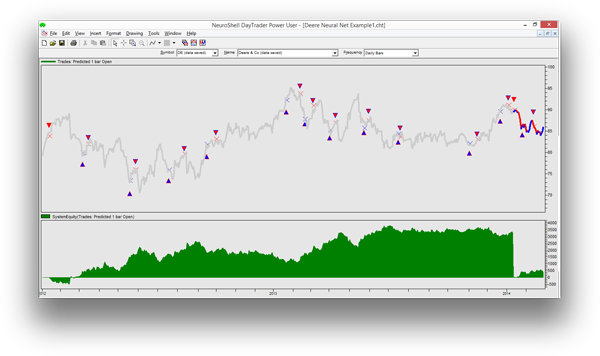

We trained a neural net on Deere (DE) data over 2 years of data. During the training period the net returned 38.1% on trades compared to 13.2% buy and hold return for the same period. That same net continued to do well through the end of for the next two months with a 4.3% return compared to a 4.0% loss for a buy and hold strategy. Inputs to the net included standard indicators such as Average Directional Movement (ADX), Commodity Channel Index (CCI), Relative Strength Index (RSI) and Stochastic %K.

Neural nets can build profitable models with your favorite indicators even when you don’t know the trading rules for those indicators. This chart displays the results for both the training data and out-of-sample data.

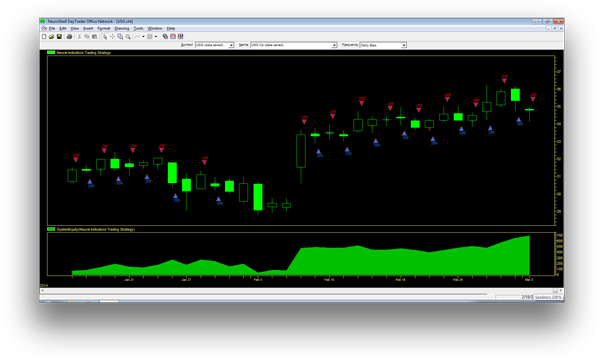

The neural nets used in the USG Corporation example are trained to indicate buy/sell probability rather than making predictions. This chart displays the results for the out-of-sample period.

Here’s another neural model we built from one of the net types you can find in our Neural Indicators (NI) add-on. NI provide output from -1 to 1 which may be interpreted as probabilities for buy/sell decisions. NI learn how to give their output based on evolutionary pressure. The genetic algorithm in the NeuroShell Trader “evolves” NI that gives better and better outputs. Survival of the fittest controls the evolutionary process, where fitness is determined by how much money the Neural Indicators make.

In this example for USG Corporation, the NI version produced a 202.1% return compared to 184.8% for buy and hold during the training period. In the out-of-sample period NI returned 21.4% compared to 13.8% for buy and hold.

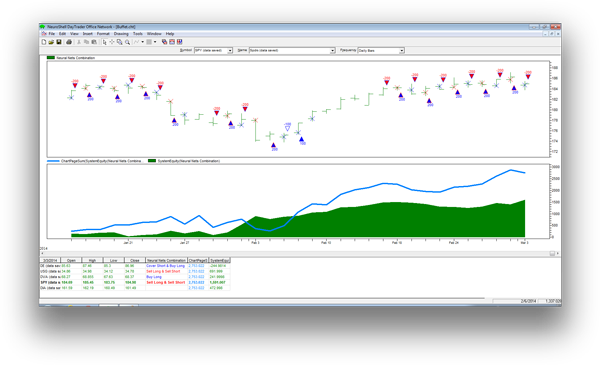

Combination Portfolio – This model combines three different neural nets to trade a basket of stocks. The chart displays the out-of-sample equity for SPY graphed in green. The blue line represents the combination equity for all 5 stocks in the portfolio.

This combination of nets bought and sold a basket of stocks whenever one of the three models indicated a trading opportunity.

NeuroShell Trader makes it easy to create models for multiple securities. Simply add a chart page for each security of interest and any model you create will be applied to each instrument. The models may be individually optimized for each security or you may choose to optimize a single model for all of the securities in the chart.

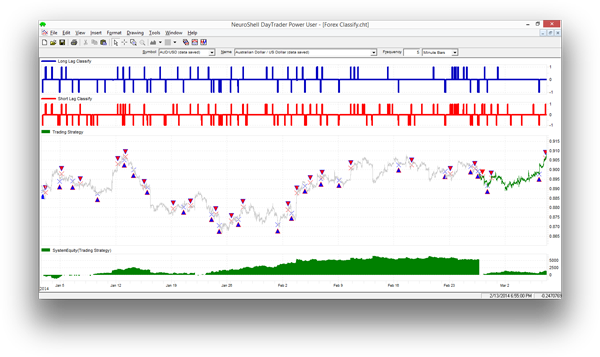

We created a Trading Strategy based on a classification neural network that compares each new bar to the patterns in the training set of data. The training set is constantly updated as the oldest bar is dropped and the newest bar is added. This type of model is particularly suited to the constantly changing FOREX market.

This model compares data from the current and previous bars to all patterns in the training set to indicate trading opportunities.

You train the models to recognize an actual output value such as 1 (strong probability of buy), numbers close to 0 (hold), -1 (probability of sell).

During the training period for the Australian Dollar/US Dollar pair, the model returned 59.5% while buy and hold only returned 0.7%. During the out-of-sample period, the model returned 14.1% while buy and hold only showed a 1.1% return.